You are here

Moody’s says Jordanian banks’ operating conditions improving, but risks remain

By JT - Feb 16,2016 - Last updated at Feb 16,2016

AMMAN – Jordanian banks benefit from gradually improving operating conditions but will continue to face challenges in 2016, says Moody's Investors Service.

"We expect Jordan's economy to pick up and public debt to stabilise, all of which should support an acceleration of credit growth," said Alexios Philippides, a Moody's analyst.

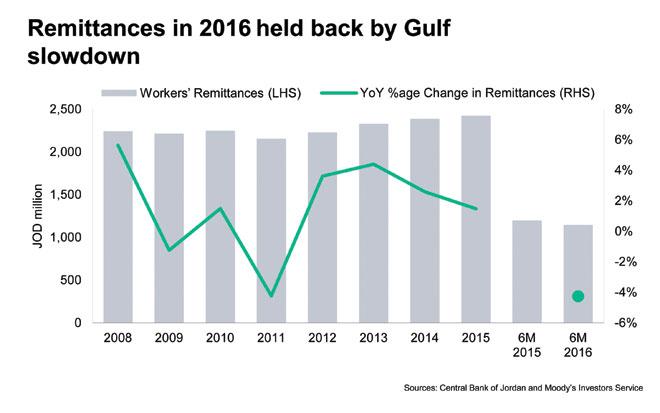

In Jordan, the international ratings agency said in a report e-mailed to The Jordan Times Tuesday, low oil prices are bolstering the Kingdom's fiscal and current account position as an oil and gas importer, while consumption and industrial competitiveness are also improving.

"However, conflicts in Syria and Iraq continue to drag on Jordan's economy, deeply affecting trade, tourism and investor sentiment, while the influx of a large number of refugees is straining public infrastructure," Philippides added.

The analyst, however, said that Jordan's banking system is large and has high overseas exposure, mainly in the MENA region, resulting in increased systemic risks and a risk of contagion given weaker operating conditions in some of these countries.

According to the report "Jordanian Banks: Resilient Amid Regional Uncertainty", however, new regulatory and structural reforms, including the establishment of a credit information bureau and the ongoing roll-out of Basel III capital and liquidity frameworks, will strengthen the resilience of the banking sector.

Moody's said that asset quality is improving as banks tackle legacy problem loans while provisioning coverage is adequate. However, credit risks remain elevated due to rising household indebtedness and high sector concentrations, especially to the Jordanian government.

Modest growth in risk-weighted assets and some profit retention will support solid capitalisation that compares well with peer countries.

The banks will also continue to benefit from a granular deposit funding base and significant liquidity buffers.

Related Articles

AMMAN — Moody's Investors Service said on Wednesday that although credit risks remain high for banks in Jordan, their sound capital and liqu

WASHINGTON — Moody's said recently that it has upgraded Turkey's credit rating on improved governance and progress on inflation, while maint