You are here

Stocks diverge on Powell nomination, Europe COVID fears

By AFP - Nov 22,2021 - Last updated at Nov 22,2021

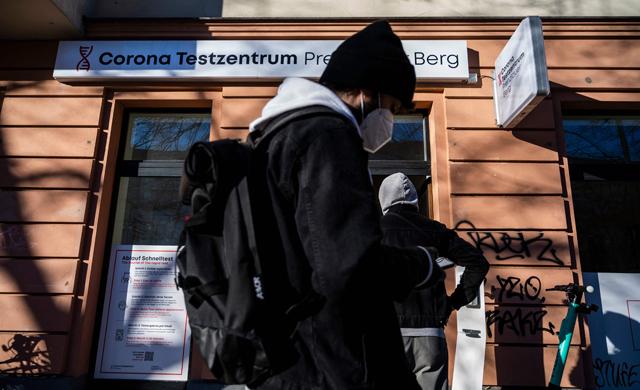

A young man waits his turn in front of a Coronavirus testing centre in Berlin on Monday (AFP photo)

LONDON — US equities rose on Monday as Federal Reserve (Fed) Chairman Jerome Powell was renominated for another term, but other stock markets wobbled as investors fretted over inflation and possible new pandemic lockdowns in Europe.

Stock prices on Wall Street opened higher after US President Joe Biden nominated Powell for a second four-year term.

By mid-afternoon, stock prices in Paris gained 0.1 per cent and prices in London were up 0.3 per cent, while Frankfurt were showing a loss of 0.1 per cent.

"There's been so much anxiety about inflation and interest rates that investors are clearly apprehensive about over-committing," said OANDA analyst Craig Erlam.

"And that anxiety has been exacerbated by the prospect of lockdowns in Europe, following Austria's announcement on Friday," he said.

On Friday, Austria surprised the markets by returning to a partial lockdown, not just for the unvaccinated as had been previously planned.

In Germany, outgoing Chancellor Angela Merkel warned that the country's current COVID curbs — including barring the unvaccinated from certain public spaces — "are not enough".

"European stocks slipped as Angela Merkel fanned concerns over the fourth wave of COVID in Europe," said ThinkMarkets analyst Fawad Razaqzada.

"The fear among market participant [is] that fresh lockdowns could be introduced in other parts of Europe, making the road to recovery from the pandemic even bumpier and raising concerns over the efficacy of the vaccines," Razaqzada said.

"So, there is now a real possibility we may see at least a short-term correction, as investors wake up to the risks facing the eurozone economy, after the major stock indices hit repeated all-time highs in recent weeks."

Earlier, Asian stock markets finished mixed as investors mulled Europe's new containment measures alongside growing speculation of interest rate hikes to tame spiking inflation.

Oil was flat, regaining some of its earlier losses after major consumers including the United States considered releasing some of their reserves to keep a lid on prices, which have been a key reason for elevated inflation this year.

Crude had tumbled on Friday on fears of adverse demand fallout from the fast-moving COVID crisis.

Related Articles

LONDON — Oil prices soared Wednesday above $113 per barrel and natural gas spiked to a record peak, as investors fretted over key producer R

LONDON — Europe's major stock markets advanced on Wednesday as investors drew strength from easing Omicron virus concerns and shrugged off a

LONDON — World stock markets rose on Monday, with Wall Street starting the new month on a steady footing ahead of a raft of new economic dat