You are here

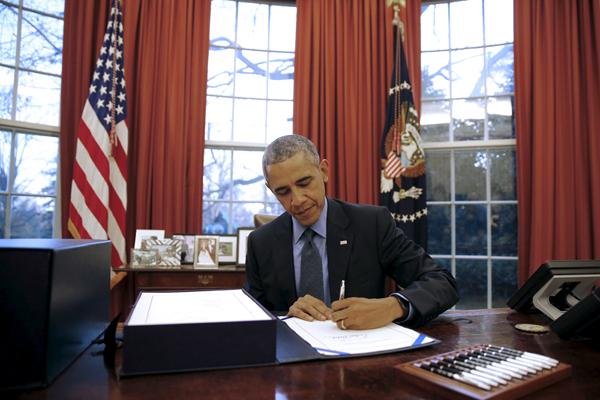

Obama wins US debt-limit, budget truce through end of presidency

By Agencies - Oct 31,2015 - Last updated at Oct 31,2015

WASHINGTON — US President Barack Obama early Friday won congressional passage of legislation that lifted the threat of a default on government debt through the end of his presidency and a budget blueprint easing strict spending caps through September 2017.

The Senate voted 64-35 to approve the measure, which was negotiated over the past few weeks by the White House and congressional leaders, including former House speaker John Boehner, who retired from Congress.

Obama will sign the bill into law as soon as he receives it, the White House said in a statement.

Without action by Congress, the Treasury Department would have exhausted the last of its borrowing capacity on November 3, according to Treasury Secretary Jack Lew, and risked default on US obligations within days that would roil global financial markets.

The two-year budget provision provides new top-line spending levels for Congress for the fiscal year that began October 1 and the one starting October 1, 2016.

It loosens budget caps, allowing an additional $80 billion in spending on military and domestic programmes over the two years.

But lawmakers still need to allocate that money among thousands of budget-line items. They face a December 11 deadline, when existing spending authority by government agencies expires, and a spirited fight is expected.

Obama called on Congress to build on the budget "by getting to work on spending bills that invest in America's priorities without getting sidetracked by ideological provisions that have no place in America's budget process".

Conservative Republicans are likely to try to attach controversial policy add-ons, such as prohibiting funding for women's healthcare provider Planned Parenthood to punish the group for an abortion-related controversy involving fetal tissue.

Some may also try to undo Dodd-Frank Wall Street reforms enacted after the 2008-09 financial crisis or prohibit new regulations on carbon emissions.

During Senate debate on Thursday, conservatives railed against the budget and debt limit bill.

Republican Senator Rand Paul, who is running for the Republican nomination for president, complained in a floor speech: "The right's going to get more military money. The left's going to get more welfare money. The secret handshake goes on and the American public gets stuck with the bill."

Senator Ted Cruz, a rival Republican presidential hopeful, returned to Washington from the campaign trail to accuse Republican majorities in Congress of "handing the president a blank credit card for the remainder of his tenure".

Senate Majority Leader Mitch McConnell, a Republican who helped negotiate the bill, praised the measure for rejecting tax increases and noted that the added spending would be offset by savings elsewhere in the government.

He also said it would "enact the most significant reform to Social Security since 1983". The estimated $168 billion in long-term savings from the programme would be achieved by clamping down on medical fraud and excess claims associated with disability benefits.

Separately, the International Monetary Fund (IMF) on Friday urged the Federal Reserve (Fed) to be cautious on raising rates, warning that tightening too fast could force it to reverse and possibly lose credibility.

In a review of the world's top industrial economies ahead of the November 15-16 Group of 20 (G-20) summit in Antalya, Turkey, the IMF said the United States and the global economy face risks tied to the impending rate hike, which would be the first in more than nine years.

The Fed on Wednesday put off the decision, but pointed to the distinct possibility that it could happen in December.

While a rate rise would represent the Fed's confidence in US economic growth, the IMF warned that it could happen "amid large uncertainty about slack in labour markets, the neutral policy rate and the path for inflation and wages."

It said global financial stability is often in the balance, given that an increase in the Fed's benchmark rates could spark "abrupt" shifts in global investment portfolios and high market volatility.

Domestically, the IMF added, "should financial conditions tighten more than warranted by cyclical conditions, it may become a drag to the recovery, and may force the Fed to reverse direction, with a potential cost in terms of credibility".

And it could also drive the dollar higher, with more negative consequences for US exports.

The IMF had advice for other G-20 economies as it pushed more efforts to right global economic "imbalances", such as excess debt and huge trade surpluses.

It said the United States, Japan, and France, most notably, need strong medium-term plans to cut their debts.

Surplus countries like Germany and the Netherlands can afford to spend more and spur growth at home and across the sagging eurozone.

As for China, the world's second largest economy, the IMF said the country needs to work to prevent "too sharp a slowdown in growth" while advancing structural reforms.

The reforms are crucial "to unleash new sources of growth and rebalance the economy towards consumption over the medium term", it said.

It also urged Beijing to rein in credit growth and slow investment growth to reduce risks in the domestic economy.

"Finding the right mix of reducing vulnerabilities and maintaining growth will be an ongoing challenge," it added.

Related Articles

WASHINGTON — At their national convention in 2012, Republicans mounted a clock counting the growing US national debt on the wall, a warning

WASHINGTON — China, India and Russia will soon speak with a louder voice at the International Monetary Fund (IMF).After years of opposition,

The US Congress approved an increase in the country’s debt limit through March 2015, bowing to President Barack Obama’s demands to extend federal borrowing authority without conditions, but only after a dramatic Senate vote on Wednesday.